WE INVEST IN IMPACT

STARTUPS + FINANCE

COMPANIES & PROJECTS

OUR INVESTMENT THESIS/

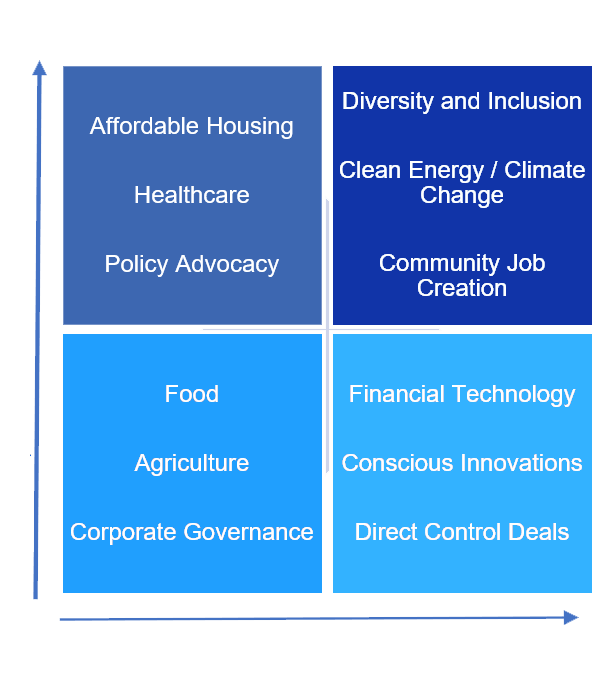

Conscious Markets partners with companies that are doing well in their local markets and are ready to scale, generate jobs, or introduce new technology. We also work with underdeveloped land and projects that can be a boost to the local economy. Our portfolio investments must pursue a double-bottom line of creating socio-economic value. We believe these projects have longer staying power and potential for market leadership in a time when the market is shifting towards conscious capitalism.

The appeal of local markets is clear. While often times community loans tend to be perceived as higher risk, according to the CDFI Fund (US Dept of Treasury agency), 75% of the foundations that made loans over the past 40 years achieved a 0% default rate.

We bring expertise focused on key areas including:

- Emerging Technology (Fin-tech, Green-tech, Health/Bio-tech, and Housing-tech)

- Healthcare and Life Sciences

- Sustainable Energy and Agriculture

- Real Estate Community Development

- Government Programs and Public Private Partnerships

- Investment Product Structuring

PORTFOLIO & RISK MANAGEMENT

Target Assets

Our portfolios will invest through low-to-medium risk instruments of SME debt finance, project-based debt and equity financing, venture capital, social impact bonds, alternative funds, and hybrid investment products.

Portfolio Construction

Company portfolios are constructed with an optimization equation that includes financial and societal returns. The Company leverages a common Social Return on Investment (SROI) framework. We also measure performance against traditional financial benchmarks used by commercial lenders and PE/VC firms.

CORPORATE CULTURE/

Credit Culture

Management maintain a growth-focused credit culture focused on competitive market pricing, flexibility for borrowers, and measurable impact outcomes.

Innovation Culture

We apply an understanding of innovation as it regards to social impact, as a process, rather than as just introducing new products and services. This process includes turning uncertainties into knowledge, and knowledge into new solutions, and scaling those while managing risks.

Community Building / Civic Engagement Culture

Utilizing localized government incentives, shared technology infrastructure, a dedicated staff, and common missions, the Company aims to facilitate collaborative development that works with stakeholders of our investments and their communities from start to finish, encouraging civic engagement, continuous communication and shared measurement of results. This approach also brings together other impact financers as co-investors. In summary, local collaboration and government incentives provide better access to capital for deals, competitive returns and improve the usage of resources.

EVALUATION & REPORTING

Conscious Markets uses a transparent performance evaluation that uses feedback from all involved stakeholders (including our investors and Community Advisors Network) to quantify the impact outcomes that matter most important to them, and to their communities.

Management uses a customized Social Return on Investment (SROI) framework–having existed as a conceptual research area for over 60 years, to create an impact matrix and Efficient Impact Frontier that plots our expected social and financial returns from individual deals and the overall portfolio. This looks at both traditional metrics of financial returns and the metrics our projects and communities have determined crucial to impact.

We report on both areas semi-annually.