BY INVESTING IN IMPACT-FOUNDERS & LOCAL PROJECTS, WE WILL DRIVE

SOCIAL PROGRESS

INVESTING IN OUR FUTURE/

Supporting small business, community equity, and technology are keys to generational progress for all peoples.”

By providing well-priced capital to successful innovative business, we can, together, continue to serve our communities, promote equity and financial stability.

OUR MISSION

is to heal and revive communities

Conscious Markets Group is a community development investment company that commits equity and loans to small and medium sized businesses and real estate projects. We partner with companies, founders, developers, and vendors providing positive social, environmental, or economic impact or serving underserved communities. By encouraging and evaluating all companies based on a double-bottom line social and financial return, we aim to strengthen civic engagement and collaboration. We leverage hybrid philanthropic models to increase community equity ownership.

In summary, we fund SMBs, technology, and community development projects and provide development services seeking to reduce disparities, uncertainties and risks to local investment, partnering with all stakeholders including community members, vendors, local government officials, and banks.

Led by a management team with 80+ years of investment management, investment banking, civic, technology and venture advisory experience; as well as operational C-Suite startup expertise with exits, and advisors who are shareholders with 100+ years of experience in asset management, inclusive housing and real estate, marketing, faith ministry, and civic advisory, Conscious Markets provides businesses and development projects with flexible financings. In real estate, we utilize tax-advantaged government programs such as the Opportunity Zone program, and with a localized approach to identify hidden gems.

Our Community Advisors Network (CMG CAN) helps us identify and consciously scale investments.

So what are Conscious Markets? These are markets of the future, that are built from the ground up to serve all, with a double-bottom line social and economic return in mind. Conscious investors are intimately aware of how their deals affect their stakeholders including communities. The model aims to create opportunities for communities traditionally overlooked by the financial markets.

How do we form Conscious Markets? We alter market incentives, and form/reform them via a constant feedback loop that includes all stakeholders of the communities we affect, and whereby investment and innovation are processes, not one-time things. Management look at impact measurement as integral to our long-term success. Together, we can continue to serve our communities and achieve financial and social deluge. For more, please see our Investment Strategy page.

OUR GOALS

- Improve access to capital for social enterprises and underserved community developments

- Provide development support to companies and projects serving our target communities, including helping businesses systematically collect data, and to implement innovation and digital strategies for a post-pandemic world.

- Strategically leverage government incentives to bridge gaps

- Increase the competitiveness of impact investing sectors, creating a bridge between for-profit, SRI, ESG and impact investing through technology and investment structures that provide at or above-market returns.

- Generate positive financial, social and environmental returns.

- Enable other public and private national and international investors to support local entrepreneurs by participating in our investment products.

OUR CORE VALUES

- Conscious Commercialization

- Positive Socio-Economic Returns

- Community Building that Heals

- Strengthening Civic Engagement

- Innovation for the Long-term

OUR CORPORATE GOVERNANCE

The company is under the supervision of the Board of Advisors, which may exercise such powers subject to any limitations set forth in the Bylaws of the company. Advisory board duties include approving corporate policies, operational goals and advising on their execution, annual budgets, committee appointments, and executive appointments. Advisory board members also actively contribute to development services and relationships with key stakeholders on behalf of the company.

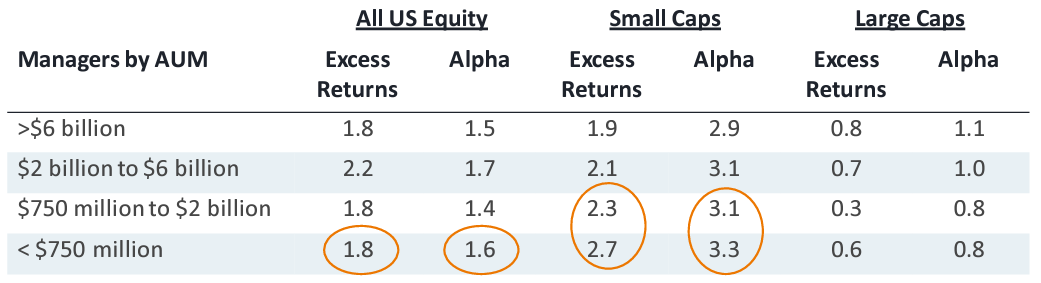

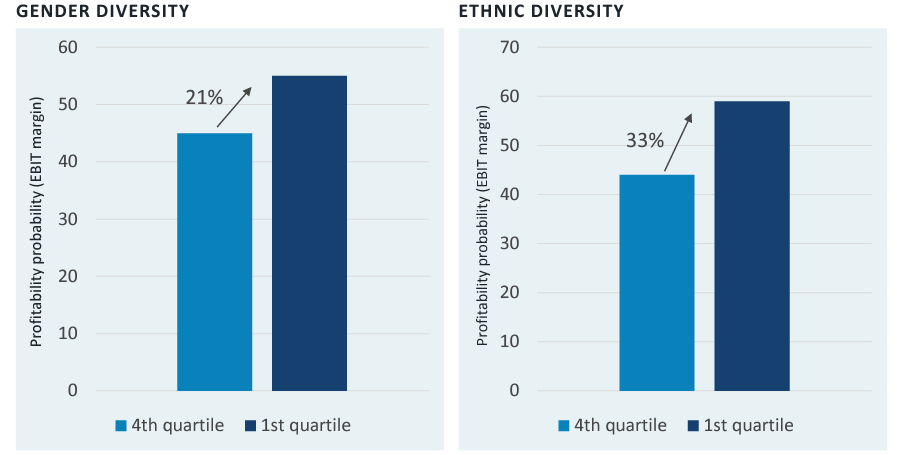

DIVERSE & EMERGING MANAGERS OUTPERFORM

- Emerging Investment Managers outperformed established ones in the last 20 years, according to a study based on eVestment Alliance database as of 10/29/2018 (survivorship bias removed).

- Data found in Change Makers Club: How Gender Diversity Impacts Profitability, shows a diverse startup manager outperformance of 21-33% more profitability. Results are statistically significant at p-value <0.51.